Blinkfire’s take on Meta’s earnings

With Meta’s (aka Facebook) earnings call after hours yesterday evening, we couldn’t help but take a read through the report. While Blinkfire doesn’t specialize in financial analysis, using the tools we’ve built to measure sponsorships, we saw several leading indicators of Meta’s weak Q4 2021 numbers.

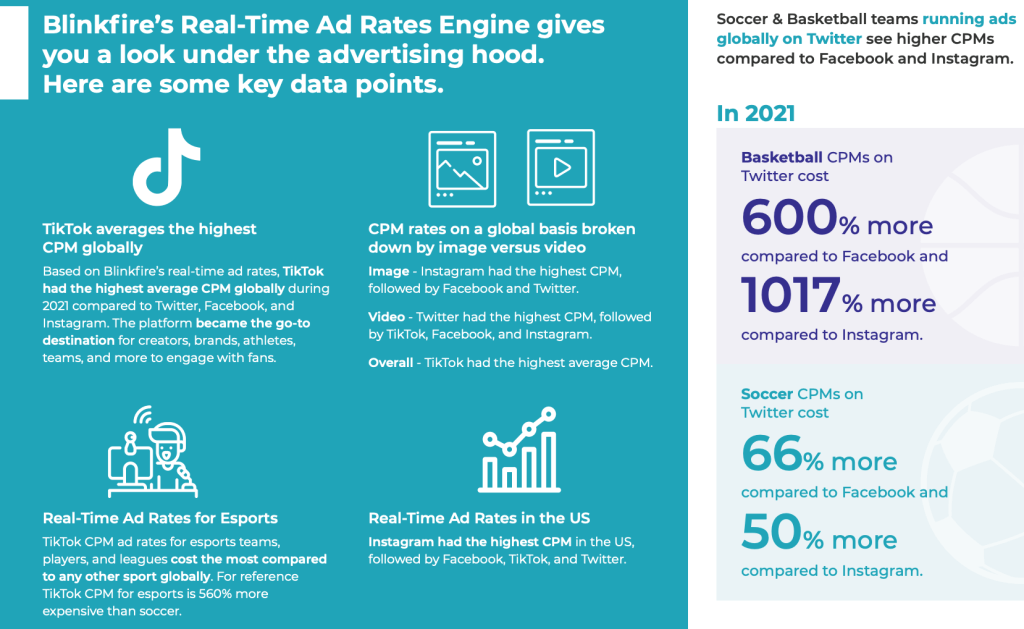

Three weeks ago we published our Blinkfire Analytics 2021 Insights Report full of data points on social media channels, content trends, and brand partnerships. One theme throughout the report, while subtle, was a decline across Facebook, including number of posts in our platform, ad rates, and usage. Additionally, Chinese networks like Douyin, Sina Weibo, and Line had a big year in 2021 — and we can’t forget TikTok.

We said, they said: Blinkfire Analytics & Meta’s earnings

Below are a few callouts from Meta’s earnings that we also brought to light in our year-end report.

The growth of Reels

- Blinkfire: IG Reels reigns supreme on Instagram. In 2021, Reels averaged far more average video views compared to Instagram’s Timeline, Stories, and IGTV. Impact: lower monetization rates.

- Meta: There’s been a shift to products that don’t generate as much revenue as its core news feed. For example, people are spending more time on its Reels videos. “On the impressions side, we expect continued headwinds from both increased competition for people’s time and a shift of engagement within our apps towards video surfaces like Reels, which monetize at lower rates than Feed and Stories,” Facebook said.

Digital & Social Activations

- Blinkfire: More brands are turning to teams, leagues, athletes, and influencers for brand partnerships. What does this look like? In many cases — campaign-specific digital activations. While we didn’t call out specific reasons in our report, it’s a trend we’ve noticed for the past few years. Rather than a brand running ads on Facebook or Instagram, partner with an influencer or team, and target their unique, authentic audience. On top of that, privacy changes are making it even more challenging for brands to advertise (which Facebook called out in their earnings call).

- Meta: Facebook said it’s being hit by a combination of factors, including privacy changes to Apple’s iOS.

Facebook loses users to other platforms like TikTok

- Blinkfire: In 2021, Blinkfire’s platform saw a 20% decrease in the number of posts from Facebook. More entities shifted their posting strategy to platforms like TikTok, or Asian networks like Douyin, Sina Weibo, and Line.

- Meta: Daily Active Users (DAUs) on Facebook were slightly down in the fourth quarter compared to the previous quarter, marking this their first quarterly decline in DAUs on record.

Lower ad revenue

- Blinkfire: Partnering with sports teams to run digital activations returns a 3-5x better engagement rate compared to running promoted ad campaigns (on such platforms as Facebook, Instagram, and Twitter). Additionally, Blinkfire’s Real-Time Ad Rates Engine calculated that TikTok had the highest CPM globally in 2021.

- Meta: Meta is expecting to lose out on ad dollars to such platforms as TikTok. Meta’s Instagram platform uses short-form video feature Reels, TikTok dominates the space. Meta is not only losing consumers to TikTok but also seeing lower revenue from ads destined for the shorter format on its own apps.

No Comment